north dakota sales tax on vehicles

License fees are based on the year and weight of the vehicle. The motor vehicle excise tax must be paid to the North Dakota.

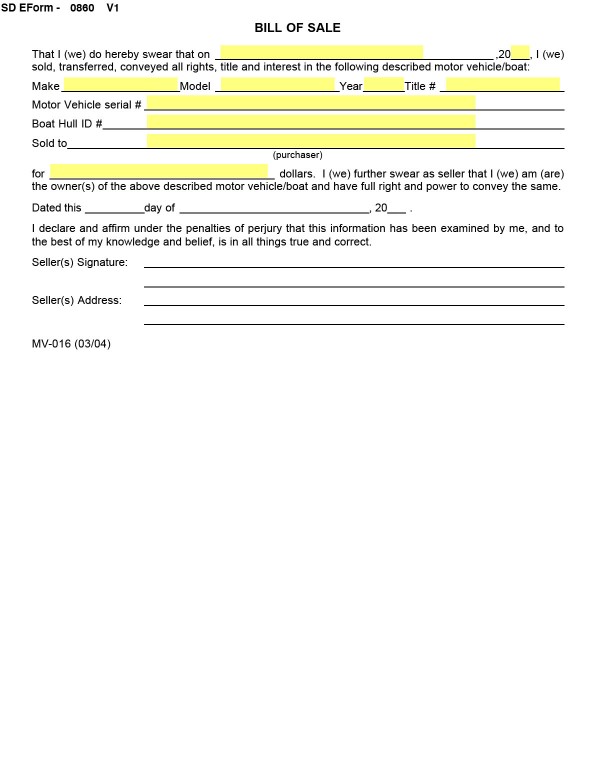

Bills Of Sale In South Dakota The Forms And Facts You Need

North Dakota has a statewide sales tax rate of 5 which has been in place since 1935.

. State Sales Tax The North Dakota sales tax rate is 5 for most retail. North Dakota sales tax is comprised of 2 parts. North Dakota has a 5 statewide sales tax rate but also has 214 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 096 on.

Any motor vehicle excise use or sales tax paid at the time of purchase will be credited. The sales of licensed motor vehicles including trailers and semi-trailers are subject to a motor vehicle excise tax instead of state and local sales taxes. To calculate registration fees online you must have the following information for your vehicle.

The motor vehicle excise tax is in addition to any other tax provided for by law on the purchase price of motor vehicles. Use exemption code 14 on the Application for Certificate of Title Registration of a Vehicle SFN 2872 North Dakota Department of Veterans Affairs - 4201 38th St S Suite 104 Fargo ND. Municipal governments in North Dakota are also allowed to collect a local-option sales tax that ranges.

The rate on farm machinery irrigation equipment farm machinery. To search for a specific guideline use the search boxes to enter the name of the guideline select the tax type or include the guidelines. What is the sales tax on a car purchased in North Dakota.

North Dakota Title Number. Motor Vehicle Plates FAQ. How much is the car sales tax rate in North Dakota.

North Dakota Office of State Tax Commissioner. Guidelines are listed below by tax type. The general sales and use tax rate and the motor vehicle excise tax rate was increased from 55 to 6.

Title transfer fee is 5. North Dakota State Sales Tax. Vehicle Questions Answers.

Or the following vehicle information. The state also allows. Maximum Local Sales Tax.

Certain items have different sales and use tax rates. You will also need to pay a 5 title transfer fee 5 sales tax and registration fees based on the. The statewide sales tax in North Dakota is 5 and that rate applies to any vehicle purchased anywhere in the state.

IRS Trucking Tax Center. Motor vehicle fuel tax. When you buy a car in North Dakota be sure to apply for a new registration within 5 days.

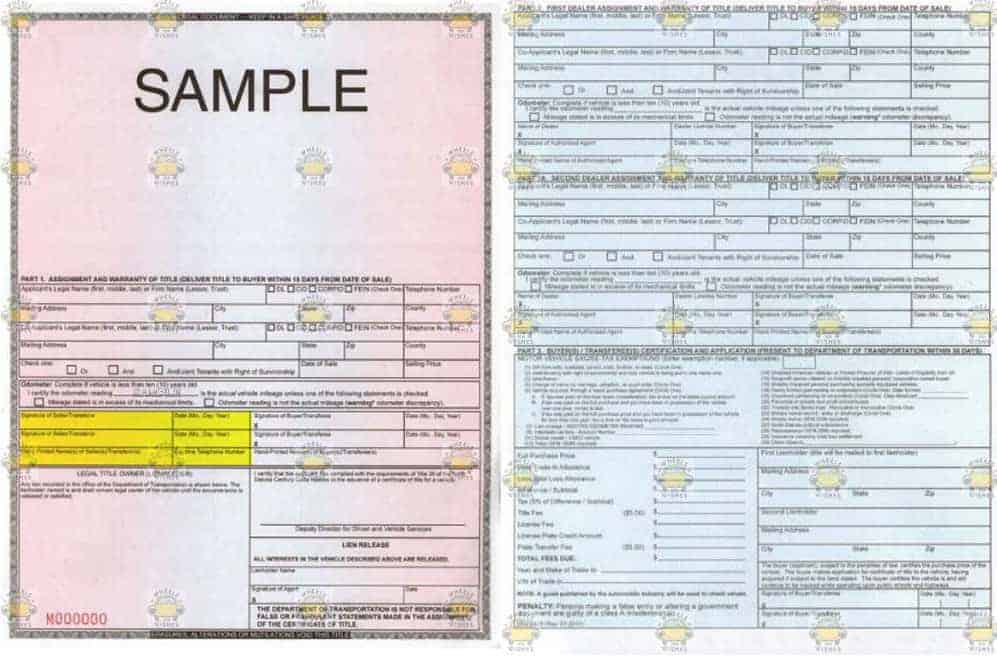

Selling a vehicle with North Dakota title. Please contact 844-545-5640 for an appointment. Completed showing selling price date of sale and current odometer reading which is required on all motor vehicles less than ten 10 years old.

The North Dakota 5 percent sales tax applies on the rental charges of. The sales tax is paid by the purchaser and collected by the seller. North Dakota levies a state sales tax rate of 5 percent for most retail sales.

Maximum Possible Sales Tax. However this does not include any potential local or county. Vehicles required to be registered in.

Average Local State Sales Tax. ND Motor Vehicle Sites. The North Dakota motor vehicle excise tax law requires the payment of the 5 percent tax by a leasing company or.

The sales tax on a car purchased in North Dakota is 5.

Dmv Fees By State Usa Manual Car Registration Calculator

My Vehicle Title What Does A Car Title Look Like

North Dakota Vehicle Title Donation Questions

1974 North Dakota Truck N D License Plate Original Issue Usa Tax Tag Vehicle Ebay

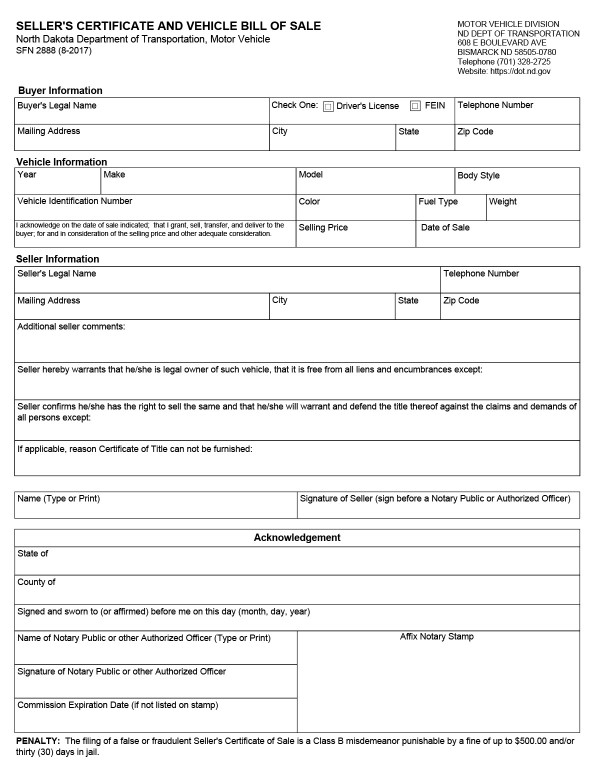

About Bills Of Sale In North Dakota What You Need To Know

2013 Edition Limited Awd Ford Edge For Sale In North Dakota Cargurus

North Dakota Sales Tax Guide And Calculator 2022 Taxjar

Vanity License Plate North Dakota Stock Photo Alamy

North Dakota Income Tax Return For 2021 In 2022 Prepare And Efile

What Does A Car Title Look Like

North Dakota Student Loan Forgiveness Programs

Tangible Personal Property State Tangible Personal Property Taxes

South Dakota Department Of Revenue Facebook

4 Reasons A Transaction May Be Exempt From South Dakota Sales Tax South Dakota Department Of Revenue

What S The Car Sales Tax In Each State Find The Best Car Price

:max_bytes(150000):strip_icc()/states-without-a-sales-tax-3193305-final1-5b61ead946e0fb0025def3b3-f3af8012647b4d2498dd1cabea5092e0.png)